In real life, bears are temperamental, scary, and – carefully monitored situations apart – cannot be tamed. People are rightfully cautious around them. When it comes to markets, the bearish are also skeptical and wary. They think the price of something is going to go down. By contrast, the bullish are, well, a lot more bullish.

Stock markets are thus labeled bullish or bearish to signal what market conditions to expect. These metaphors denote whether share prices are going up or down in value and how investors feel about this.

Mammalian Origins

The terms can be traced to the 1880s when ‘bearskin jobbers' riskily sold bearskins from bears they hadn't yet caught. The name eventually stuck.

Bears were speculators who sold shares they didn’t own by borrowing, while betting the stock they sold would drop in price, aka short sellers. Optimists who bought hoping a stock price would rise became known as bulls.

Talking Bull Markets

After a stock market crash, the government usually intervenes to help people get back to work. They enact recovery packages with subsidies to get the economy on its feet. These conditions reverberate across industries, powering growth and investment in new technology such as PaaS, which drives recovery forward in today’s digital world.

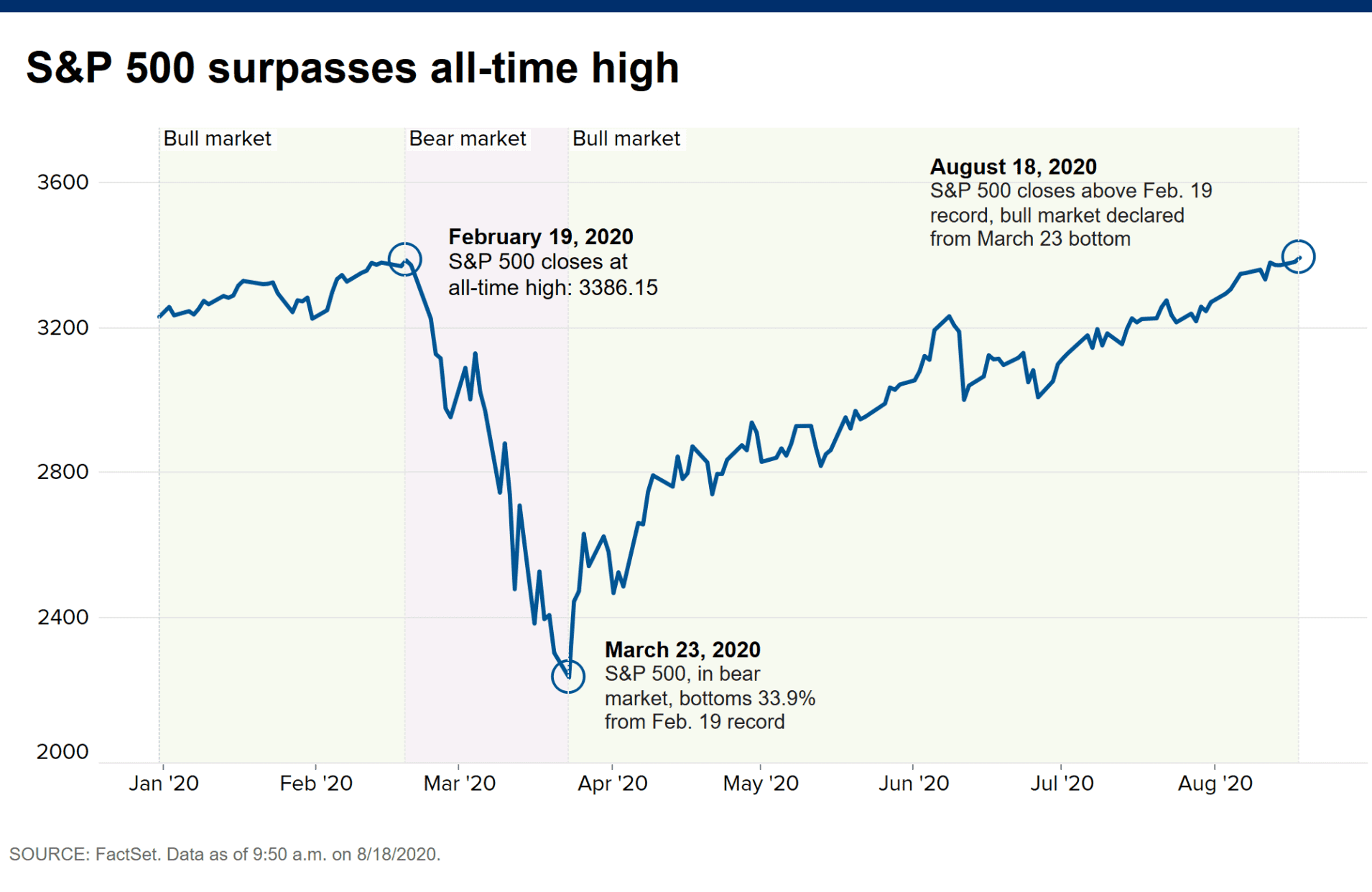

A bull market is associated with such an economic boom when conditions are favorable enough that the value of stocks appreciates. More specifically, a bull market occurs when a stock market index, such as the S&P 500, rises at least 20 percent from a recent low.

Stock prices rise steadily, buoying investors. With the economy in rude health, bull markets can result in robust economic growth and general prosperity. Life is good.

The Bear Necessities

The opposite of a bull is a bear: a downturn where the economy recedes and most stocks lose value. When the stock prices on major market indexes fall continuously, by 20 percent in stock prices over a two-month period, we describe the phenomenon as a bear market.

A bear run is distinct from market corrections, which are short-lived declines in stock prices rather than a sustained downward trend.

Good News About Bears

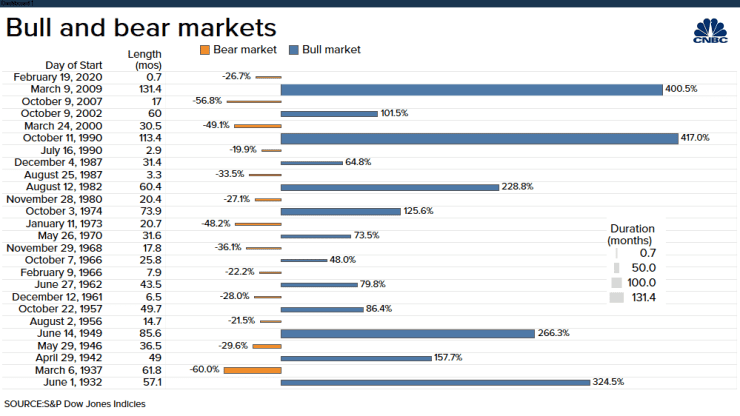

Bears can be scary but tend to be shorter than bull markets. The average length of a bear market is usually under 10 months. The most notable bear market was the Great Depression, which endured for 61 months.

An encouraging recent trend is increasingly swifter recovery from bear markets. Imagine you’re a business thinking of investing in the future – in attended automation, for example – and you’re weighing up the merits of attended vs unattended RPA. This is good news!

Typically, it takes roughly two years for the stock market to reach its previous high, but this can vary depending on the severity of the bear market. The average person can expect to live through about 14 bear markets during their lifetime.

The Continuing Story of Bungalow Bull

The economic cycle that correlates with bull and bear markets comprises four phases: expansion, peak, contraction, and trough. The market periodically moves through these bull and bear cycles, but bull markets have predominated for 78 percent of the last 91 years, producing positive returns in the long run. As such, the average investor follows suit. Bull markets last 2.7 years on average and so-called secular bull markets can endure even longer.

What Causes the Stock Market to Move In Either Direction?

Narratives Matter

Financial markets lead to self-fulfilling results. The fortunes of stocks are susceptible to the madness of crowds since, in many ways, the stock market is like a gauge of our social-psychological lives.

When the economy slows and equity prices fall over a sustained period, this creates a background of negative sentiment. Companies may postpone investment in the latest and best video conferencing software, for example.

Soon, confidence wanes, and investors sell their stocks to protect funds, resulting in a sell-off. A self-fulfilling prophecy ensues, beginning a downward spiral.

Supply and Demand

The supply and demand of securities also contribute significantly to bull and bear markets. In bull markets, demand for securities is strong, while supply is weak. With many more buyers than sellers, share prices rise. Conversely, in a bear market, supply outstrips demand as people look to sell and stock prices fall.

Changing Economic Activity

Changes in the overall economy are another factor determining which direction the market trends. In a bull run, corporate earnings and the economy grow as businesses invest in powerful new tools like eCommerce analytics and consumers spend more money due to the wealth effect. In contrast, a bear market constrains consumer priorities and spending, resulting in a decrease in business profits which also affects how the market values stock.

How to Manage Your Investment Portfolio

True, a bear market is an opportunity to take advantage of lower stock prices. Also true: internet memes have gone so far that they’ve created armies of new investors.

So, here are three investment timeline-adjacent tips on how to mitigate risk and negotiate market turbulence.

1. Inside of a Bear, It's Too Gloomy to Panic

It’s good advice to focus on the long-term. This means that if you’re investing for a long-term goal such as your retirement, as a rule the bear markets you’ll weather will be eclipsed by bull markets. Resisting the temptation to sell investments when markets crater is hard. But it generally pays to hold onto your stocks and ride it out through the good times and the bad.

2. Mix Your Portfolio Like Your Mammalian Metaphors

Another vital strategy for navigating bull and bear markets is diversifying your holdings. Bear markets spell an overall fall in the stock prices of the companies in a stock index. But crucially, individual stocks are affected differently. Just as forward-thinking companies today take steps to ensure their digital asset security, you should regularly rebalance a diverse portfolio of stocks, bonds, and cash to ensure you’ve invested in a mix of relative winners and losers and mitigate your portfolio’s overall risk.

3. Out of the Woods

Finally, consider maximizing your overall portfolio gains by smoothing out your investment over time. This strategy is known as dollar-cost averaging, where you invest money continually over time in approximately equal amounts. This prudent approach guard against the sometimes ruinous temptation to ‘time’ the market.

Paws for Thought

In the economic disruption of the post-pandemic era, financial literacy is more important than ever. As investors exult about bull markets and run away from bears, at least you’ll know what to expect moving forward.

Author Bio:

Patty Yan is the EMEA Product Marketing Manager for RingCentral Office, the leader in cloud communications and business VoIP solutions. Patty is passionate about creating value and differentiation, ensuring a better experience for customers and partners. She gained a wealth of international product marketing, product management, GTM and market development experience, across a range of high-tech SaaS in a fast-paced, hyper-growth environment that assumes both strategic and tactical execution. She is not new to UC, starting in Tandberg, then Cisco, driving the launch of video collaboration and services, and Enghouse with global responsibilities for hosted CCaaS.

Patty Yan is the EMEA Product Marketing Manager for RingCentral Office, the leader in cloud communications and business VoIP solutions. Patty is passionate about creating value and differentiation, ensuring a better experience for customers and partners. She gained a wealth of international product marketing, product management, GTM and market development experience, across a range of high-tech SaaS in a fast-paced, hyper-growth environment that assumes both strategic and tactical execution. She is not new to UC, starting in Tandberg, then Cisco, driving the launch of video collaboration and services, and Enghouse with global responsibilities for hosted CCaaS.

|

|